Sometimes, the Best Move is No Move

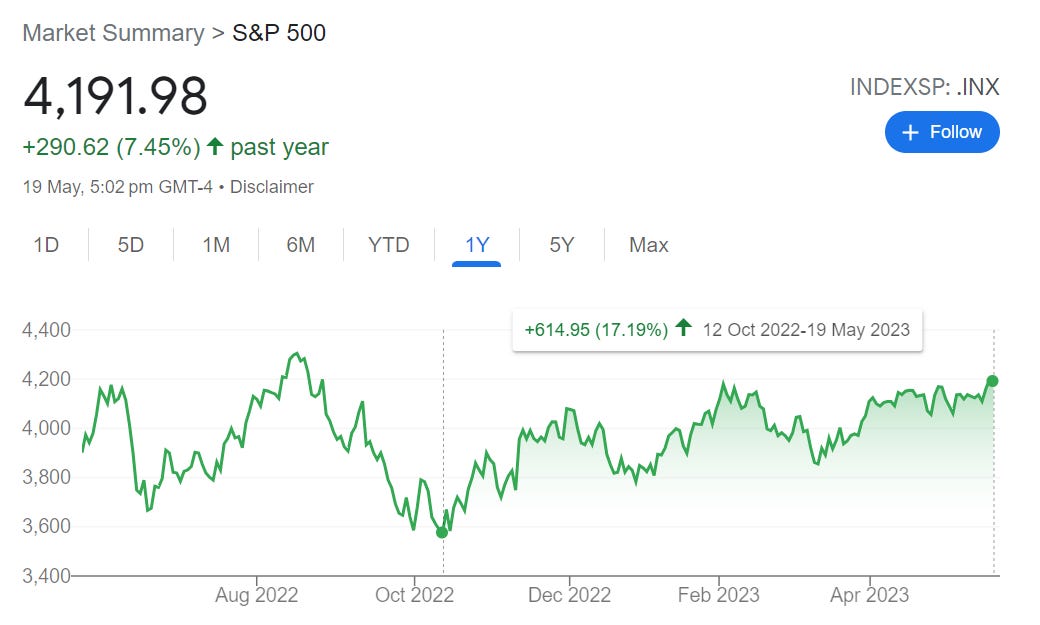

Recently, a sense of bullishness has made a comeback in the market. Since its low point in October 2022, the S&P500 has risen by 20% and the QQQ by 32%. Despite these increases, I can't help but feel that the stock market has become somewhat detached from reality. Here's why:

Although the recent corporate earnings saw many companies surpass estimates, many of these firms haven't demonstrated remarkable results in terms of growth and profitability. They've simply outperformed rather modest expectations. In fact, the growth rate of numerous companies is lower now than it was between 2021-2022.

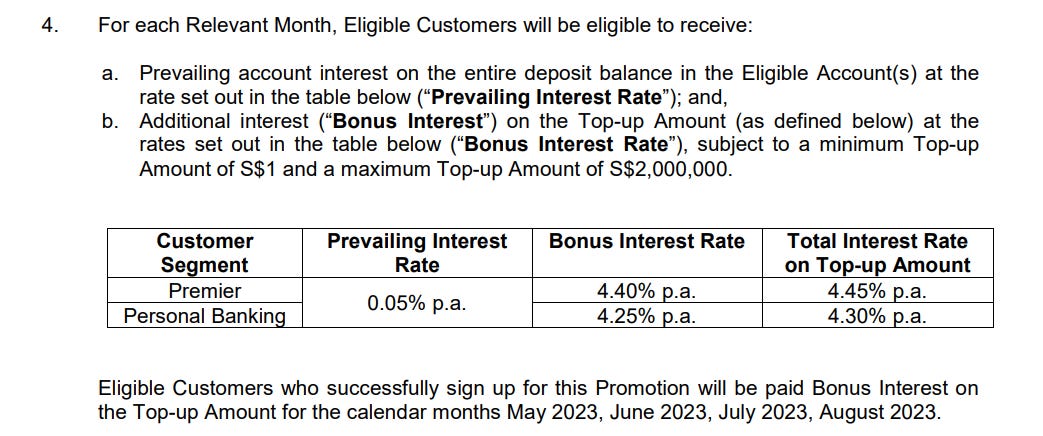

Interest rates remain high. Such high rates always act as a gravitational force on stock valuations because investors have the option of parking their money in high-yield savings accounts, offering a decent return with less risk.

From a macroeconomic perspective, inflation stubbornly persists at high levels, suggesting that the US Fed is unlikely to cut interest rates in the near future. If high interest rates persist, more sectors, like commercial real estate and regional banks, could face financial stress. This scenario isn't favorable for the stock market.

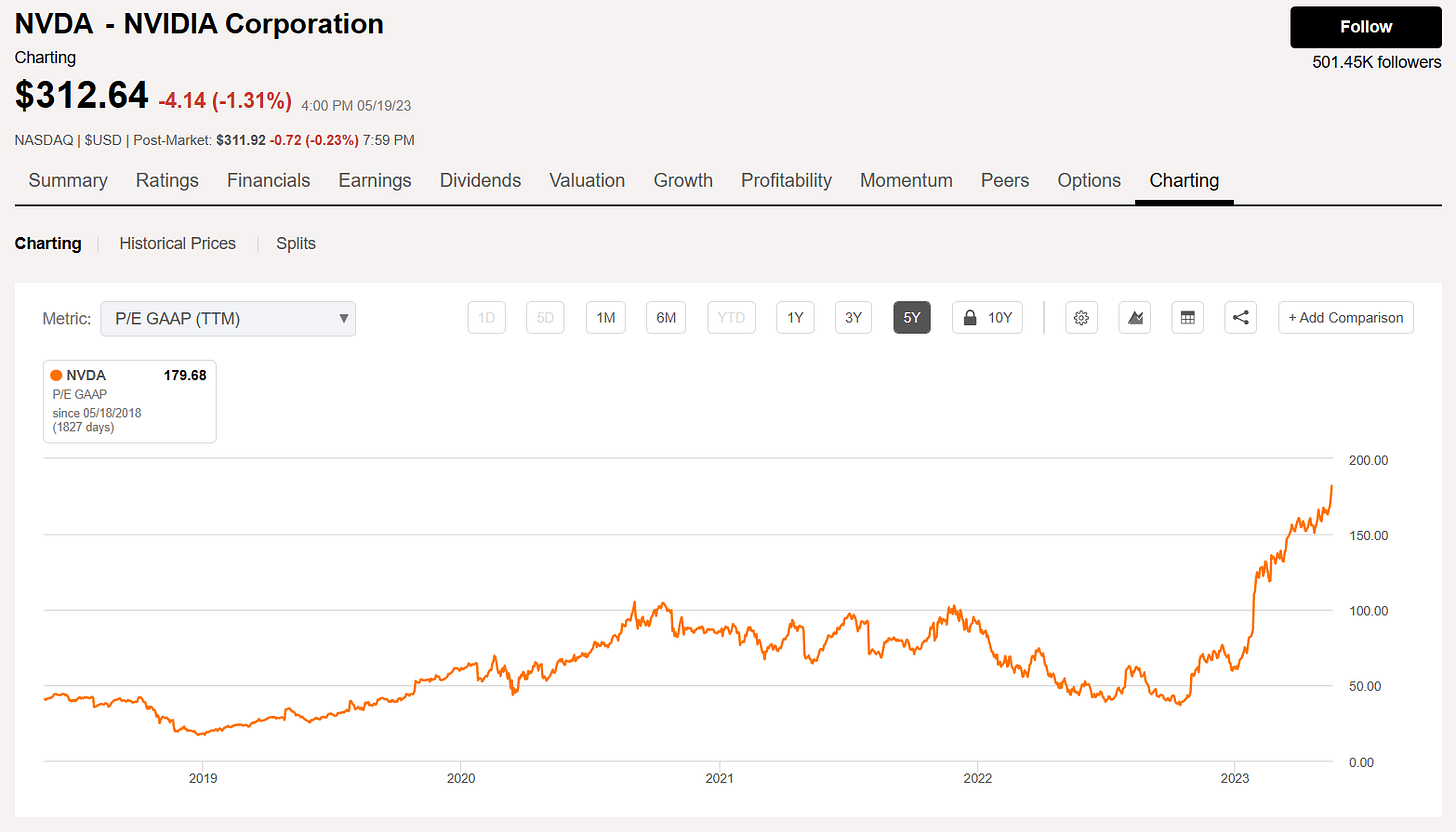

It appears that the companies faring well are predominantly in the realm of Artificial Intelligence. While I do believe that innovation in areas like large language models and generative AI will reshape the future, the full impact on companies like Nvidia, Microsoft, and Google remains uncertain. For these companies' intrinsic value to increase, we'll need to witness a rise in their revenue, profitability, and growth.

In terms of my own portfolio, I've been deploying money every month, though at a slower pace than last year. The past few months have seen a surge in expenses as I booked and paid for a family vacation planned for year-end. Concurrently, I've started building up a small cash reserve in high-yield savings accounts, such as HSBC EGA, and invested in 6-month T-bills. For some, this strategy may seem like attempting to trade the market, and to some extent, that's true. However, I haven't been "taking profits" from my portfolio, even though I believe a few companies I own are currently overvalued.

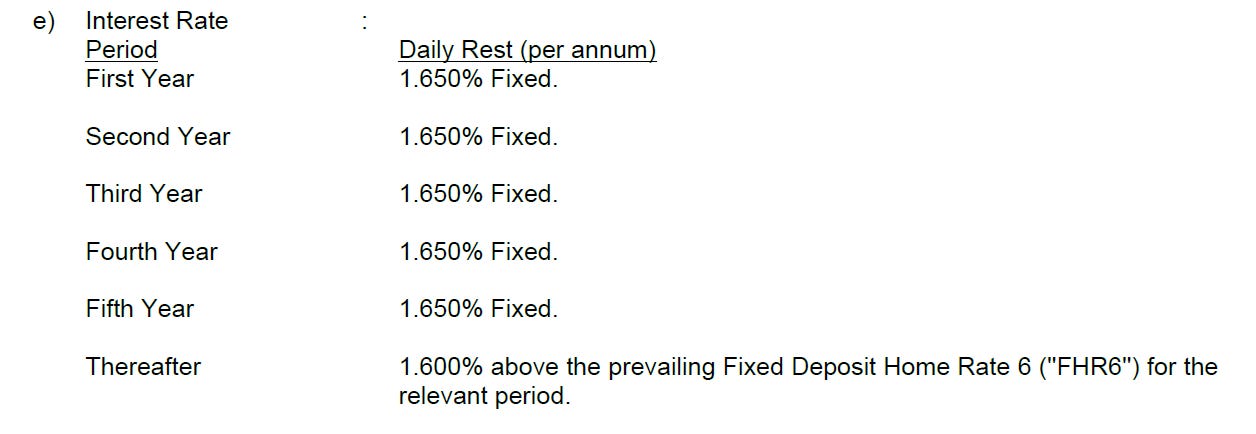

With regard to the cash reserve I've built up, it's unlikely that I will deploy it aggressively during the next market downturn. The reason is simple: I have a mortgage of $250K, which I was fortunate enough to lock in with DBS at an interest rate of 1.65% for 5 years. This arrangement allows me to enjoy a low interest rate for the time being. However, once this fixed period ends, refinancing the mortgage at an attractive rate will be challenging, given the small mortgage amount and the banks' reluctance to negotiate. I anticipate that the effective interest rate could jump to 4.5% after 4 years. In preparation for this, I aim to pay down the mortgage as quickly as possible - a task made easier by starting to accumulate some cash now.

In conclusion, if the market continues to remain bullish, I will persist with my strategy of dollar-cost averaging and purchasing stocks, albeit in smaller amounts. I believe that time in the market consistently outperforms timing the market in the long run. Given the recent bullishness in the stock market, building up some cash on the side isn’t a bad idea either, considering that I will enjoy high interest rates (while they last) and can use the money to pay off my mortgage faster once the fixed-rate period concludes. This is why, in the current market environment, you may perceive me as idle, seemingly doing very little. Yet, in the midst of financial frenzy, understanding when to refrain from action is a skill in itself. Sometimes, the best thing to do truly is to do nothing. This stance might seem counterintuitive or even lazy to some, but it's a mindful strategy I've chosen to adopt given the current economic climate. After all, the art of financial patience often involves knowing when to hold back, observe, and let the market run its course.